Ohio LLC Operating Agreement - S Corporation

Form for a Single-Member, Member-Managed LLC with S Corp Tax Status

Safeguard your LLC's legal standing using this customizable single-member, member-managed Ohio operating agreement template for S Corp LLCs. With our Operating Agreement template, you can quickly and easily create a legally compliant operating agreement tailored to your unique needs.

Not sure if you need an Operating Agreement? Learn why these agreements are important -- especially for single-member LLCs.

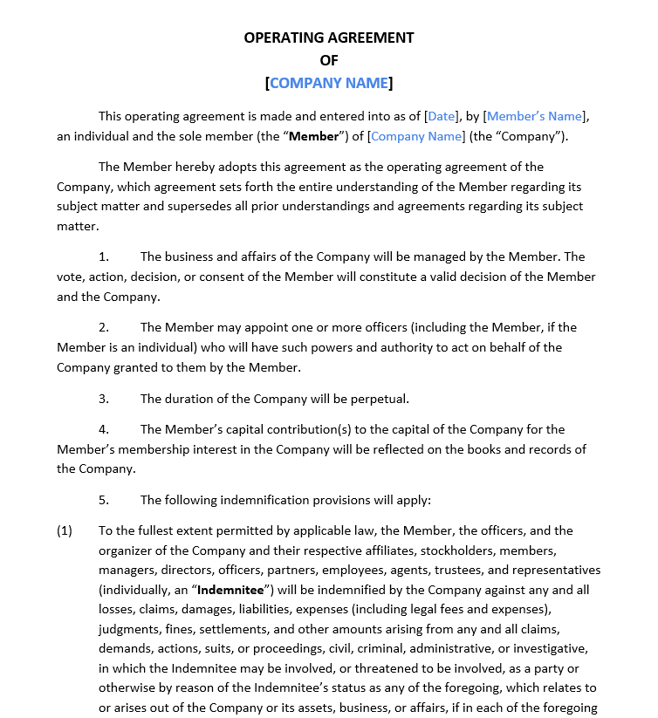

Document Preview

To get started, simply purchase the template and download it to your device. You can then customize it according to your business requirements. Our template includes the following important sections:

- Company Formation: Establishes the name, purpose, and duration of your LLC, along with its principal place of business.

- Taxation: Explains the S Corporation tax election and the member's responsibility for tax filings and payments.

- Capital Contributions: Details the initial contributions made by the member and the process for making additional contributions in the future.

- Distributions: Defines how profits and losses will be allocated and distributed to the member.

- Indemnification and Limitation of Liability: Protects the manager from personal liability for certain actions taken on behalf of the LLC.

- Dissolution: Describes the process and conditions for dissolving the LLC, including the distribution of assets and liabilities.

- Amendments: Specifies the procedure for amending the operating agreement, ensuring flexibility as your business grows.

Some of the benefits of using this single-member, manager-managed operating agreement include:

- The agreement is customizable to fit your unique business needs

- Easy-to-follow, step-by-step instructions

- Compliant with state laws and regulations

- Professionally drafted by legal experts

- Saves time and reduces potential legal disputes

- Protects your personal assets by solidifying the LLC structure

This form is appropriate for single-member, member-managed LLCs that have elected to be taxed as an S Corporation with the IRS. If you don't meet all these criteria, these operating agreements are better for you:

- Single-Member Operating Agreement (manager-managed; default tax)

- Single-Member Operating Agreement (member-managed, default tax)

- Multi-Member LLC Operating Agreement

Why Choose Legal GPS for your Legal Contract Templates?

At Legal GPS, we are committed to providing high-quality, legally compliant contract templates that save you time, money, and stress. Our team of legal experts and industry professionals work diligently to ensure our templates are up-to-date with the latest legal requirements while remaining user-friendly and easily customizable. We offer a 30-day money-back guarantee if you aren't satisfied.