LLC Operating Agreement

An operating agreement is the foundation of your LLC, setting the rules for ownership, management, and profit-sharing. It's a vital legal document that helps prevent disputes and protects your business interests. Think of it as a customized roadmap for your company's success.

Last Updated: Oct. 23, 2024

Not sure if you need an Operating Agreement? Learn why these agreements are important -- for both single-member LLCs and multi-member LLCs.

Why Your LLC Needs an Operating Agreement

An LLC operating agreement isn’t just a formality—it’s a crucial document that defines how your business operates and protects your personal assets. Here’s why every LLC, whether single-member or multi-member, needs one:

1. Protects Personal Assets

Without an operating agreement, courts may treat your LLC as an extension of your personal finances, exposing you to personal liability. A clear agreement helps reinforce the separation between personal and business assets, shielding you from lawsuits and debts.

2. Clarifies Roles and Decision-Making

An operating agreement outlines member roles, responsibilities, and voting rights, preventing confusion over who makes decisions. It ensures your LLC runs smoothly, even during disagreements or changes in management.

3. Defines Profit Sharing and Loss Allocation

Your agreement specifies how profits and losses will be distributed among members, avoiding disputes. It also allows you to set custom rules for special allocations or reinvestment strategies, tailored to your business’s needs.

4. Prevents State Default Rules from Taking Control

Without an agreement, your LLC will be governed by state default laws that may not align with your business goals. These laws might impose equal profit-sharing or require unanimous votes for key decisions—both of which can cause complications.

5. Simplifies Management and Ownership Changes

An operating agreement helps you manage ownership transfers, member withdrawals, or succession planning without disruption. Whether you’re bringing in new partners or winding down operations, the agreement ensures a clear process.

How to Purchase and Use Our LLC Operating Agreement Templates

Getting your LLC operating agreement in place is simple and quick. Just follow these five steps to purchase, customize, and secure your agreement.

✅ Step 1: Choose the Template that Fits Your Business

Select the template that matches your business structure—whether you need one for a Single-Member, Multi-Member, Manager-Managed, or Member-Managed LLC, or if your LLC is taxed as an S Corporation.

Need help selecting the right template? Explore all LLC templates here.

🛒 Step 2: Complete Your Purchase ($35 per Template)

Add the chosen template to your cart and proceed with secure checkout. Once the purchase is complete, you’ll receive the template instantly via email.

📥 Step 3: Download and Customize

Download the template. Easily edit the sections to reflect your LLC’s specific details, including member roles, voting rights, and distribution of profits.

Our templates are designed for easy customization, so you can make the changes you need without a hassle.

👥 Step 4: Review with Your Partners and Legal Advisor

Once the agreement is complete, review it with LLC members to ensure everyone is aligned. If necessary, consult a legal advisor to confirm the agreement covers all essential elements.

✍️ Step 5: Sign and Store Your Agreement

After finalizing the agreement, have all members sign it. Store the signed document safely and make sure all members have a copy.

You don't need to file it with your state.

🎯 Ready to Get Started?

Protect your business with the right agreement—choose your LLC template now here.

Why Choose Our Templates?

- Attorney-Drafted: Our templates are created by experienced legal professionals, ensuring accuracy and compliance.

- Customizable: Easily tailor each template to fit your unique business needs.

- User-Friendly: Our templates are written in plain language and come with step-by-step instructions.

- Affordable: At just $35 per template, you receive a legally compliant, thoroughly detailed document that you can customize to fit your unique business needs.

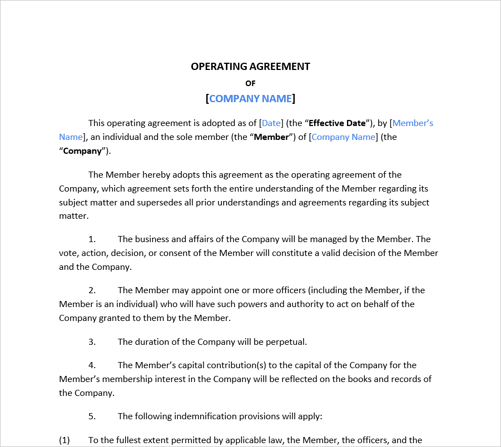

LLC Operating Agreement Sample Clauses and Key Provisions

Every operating agreement needs key clauses that define how your business will operate. Below are sample LLC provisions that you can use to shape your own agreement. These examples cover management roles, profit-sharing, member contributions, indemnification, and dissolution—core elements for any well-structured LLC.

Jump to a Specific Clause Example

- Purpose Clause

- Management Clause

- Profit and Loss Distribution Clause

- LLC Duration

- Capital Contributions Clause

- Indemnification Clause

- Dissolution Clause

Purpose Clause

The Purpose clause defines the mission and scope of activities your LLC will engage in. It ensures compliance with state regulations while giving the LLC flexibility to pursue additional opportunities.

Why the Purpose Clause Matters

- Legal Compliance: Some states require a purpose clause for LLC formation.

- Business Flexibility: A broad purpose allows your LLC to grow and pivot as needed.

- Clear Objectives: It aligns members and investors with the company’s mission.

Sample Purpose Clause

Here’s a flexible sample clause you can use in your agreement:

The purpose of the Company is [Company Purpose], and the conduct of other activities as may be necessary or appropriate to promote the stated purposes, and to engage in any other lawful business or activity for which a limited liability company may be organized under the Act.

This clause provides flexibility by allowing the LLC to pursue its primary goal while also engaging in other lawful activities without future amendments.

Types of Purpose Clauses

-

General Purpose Clause:

"The purpose of this LLC is to engage in any lawful business activity permitted by the state of formation."

(Best for businesses that want flexibility.) -

Specific Purpose Clause:

"The purpose of this LLC is to provide digital marketing services to small businesses."

(Best for businesses with a focused mission.)

Management Clause

The Management clause outlines how your LLC will be managed and defines who has the authority to make decisions. It ensures clarity between members, prevents conflicts, and establishes the structure that suits your business’s needs.

Why the Management Clause Matters

- Defines Decision-Making Authority: Clarifies who controls day-to-day operations and major business decisions.

- Prevents Conflicts: Avoids misunderstandings about roles and responsibilities among members.

- Tailors to Your Business Structure: Aligns with your LLC’s size and ownership, whether it’s member-managed or manager-managed.

Sample Management Clause

Here’s a sample clause for your operating agreement:

The business and affairs of the Company shall be managed by [Member(s) or Manager(s)] in accordance with this Agreement. Unless otherwise stated, [the Manager(s) or Members] shall have full and complete authority, power, and discretion to manage and control the Company’s activities and make all decisions regarding its operations.

This sample ensures that the authority is clearly defined and avoids ambiguity in decision-making.

Types of Management Structures

-

Member-Managed:

All members participate in managing the LLC.

(Ideal for small businesses where owners want to stay actively involved.) -

Manager-Managed:

Designated managers handle daily operations while members act as passive investors.

(Best for larger businesses or passive investors.)

Profit and Loss Distribution Clause

The Profit and Loss Distribution clause specifies how the LLC’s earnings and losses are shared among its members. This clause ensures transparency, prevents disputes, and aligns members on financial expectations.

Why the Profit and Loss Distribution Clause Matters

- Clarifies Financial Obligations: Defines how profits and losses are allocated among members.

- Prevents Disputes: Ensures all members understand their share and when distributions will occur.

- Offers Customization: Allows LLCs to set unique profit-sharing rules based on contributions or performance.

Sample Profit and Loss Distribution Clause

Here’s a sample clause for your agreement:

The Company’s profits and losses shall be allocated among the members in accordance with their ownership percentages or as otherwise agreed upon in writing by the members. Distributions of available funds shall be made at the discretion of [the Manager(s) or Members], subject to the needs of the Company for working capital and reserves.

This sample provides flexibility by aligning profit-sharing with ownership but allows members to customize distributions based on other factors.

Key Considerations for Profit and Loss Allocation

- Ownership-Based Distribution: Each member’s share is proportional to their ownership percentage.

(Example: A 30% owner receives 30% of profits.) - Special Allocations: Members may receive extra profits for contributing additional services or capital.

- Reinvestment Strategy: Profits may be retained to fund growth, as agreed by the members.

Duration Clause

The Duration clause defines how long the LLC will operate. It clarifies whether the LLC will exist indefinitely or for a set period, ensuring members understand the timeline for the company’s operations and obligations.

Why the Duration Clause Matters

- Establishes Longevity: Defines whether the LLC operates indefinitely or has a specific end date.

- Prevents Legal Uncertainty: Ensures members are aligned on how long the business will remain active.

- Facilitates Planning: Helps members prepare for dissolution or renewal if the LLC has a limited term.

Sample Duration Clause

Here’s a sample clause for your agreement:

The Company shall continue in existence until it is dissolved in accordance with this Agreement or by operation of law. The Company’s duration may be perpetual unless otherwise determined by the members or as specified by the Company’s purpose or the Act.

This sample allows for flexibility, supporting either perpetual existence or a set duration.

Types of LLC Duration

-

Perpetual Duration:

The LLC operates indefinitely unless dissolved by members or law.

(Ideal for most businesses that plan to operate long-term.) -

Limited Duration:

The LLC exists only for a set period or until the completion of a specific goal.

(Best for short-term ventures or projects with defined timelines.)

Capital Contributions Clause in an LLC Operating Agreement

The Capital Contributions clause defines the amount and type of contributions made by members to fund the LLC. It ensures transparency by documenting initial investments and provides a framework for future contributions, if needed.

Why the Capital Contributions Clause Matters

- Ensures Accountability: Records the amount each member has contributed to the LLC.

- Prevents Disputes: Establishes clarity on financial obligations and ownership percentages.

- Supports Future Growth: Allows for additional contributions as the business grows or capital is needed.

Sample Capital Contributions Clause

Here’s a sample clause for your agreement:

Each member shall make an initial capital contribution to the Company in the amount set forth in the Company’s records. Additional contributions may be required from time to time as determined by the members or as needed to maintain the Company’s financial health. Failure to meet capital contribution requirements may result in dilution of ownership interests or other remedies as outlined in this Agreement.

This sample ensures members are aligned on both initial and future contributions, reducing the risk of misunderstandings.

Key Considerations for Capital Contributions

- Initial Contributions: Define how much each member must invest upon joining the LLC.

(Example: $10,000 per member for equal ownership shares.) - Future Contributions: Outline if and how members can be required to invest more capital.

(Example: Members may agree to reinvest profits or contribute new funds for growth.) - Remedies for Non-Compliance: Specify what happens if a member fails to meet their financial obligations.

(Example: Ownership interest may be diluted or forfeited.)

Indemnification

The Indemnification clause protects LLC members, managers, and employees from personal liability for actions taken in good faith while managing the company. This clause ensures that the company will cover certain legal costs, damages, or claims, shielding individuals from personal financial risk.

Why the Indemnification Clause Matters

- Protects Members and Managers: Shields individuals from personal liability for business-related actions.

- Attracts Investors and Managers: Offering indemnification makes it easier to recruit managers and secure investments.

- Reduces Legal Risk: Ensures the LLC covers legal fees and settlements arising from good-faith actions on behalf of the company.

Sample Indemnification Clause

Here’s a sample clause for your agreement:

The Company shall indemnify and hold harmless its members, managers, and employees from and against any and all losses, claims, damages, or liabilities incurred in connection with the Company’s activities, provided such actions were taken in good faith and within the scope of their authority. Indemnification shall not apply in cases of fraud, willful misconduct, or gross negligence.

This sample ensures good-faith actions are protected, while preventing abuse by excluding coverage for misconduct or fraud.

Key Considerations for Indemnification

- Scope of Indemnification: Specify which individuals (members, managers, employees) are covered.

(Example: Only actions taken within the scope of authority are indemnified.) - Exclusions: Clarify that indemnification does not apply to fraud, misconduct, or negligence.

(This protects the LLC from covering wrongful actions.) - Legal Defense Costs: State whether the LLC will cover legal fees upfront or reimburse after resolution.

Dissolution Clause

The Dissolution clause outlines the process for winding down the LLC’s operations. It ensures that members are aligned on how and when the LLC will be dissolved and provides a clear framework for distributing assets and closing the business legally.

Why the Dissolution Clause Matters

- Establishes Clear Procedures: Prevents confusion about the steps required to dissolve the LLC.

- Avoids Legal Issues: Ensures compliance with state regulations when closing the business.

- Manages Asset Distribution: Defines how remaining assets will be distributed among members after debts are settled.

Sample Dissolution Clause

Here’s a sample clause for your agreement:

The Company shall be dissolved upon the occurrence of any of the following events: (a) a vote of the members in accordance with this Agreement; (b) the sale or disposition of all Company assets; or (c) the entry of a decree of judicial dissolution. Upon dissolution, the Company shall wind up its affairs, pay off liabilities, and distribute any remaining assets to the members according to their ownership percentages.

This sample provides a clear, flexible framework for dissolving the LLC when necessary, while ensuring legal compliance.

Key Considerations for Dissolution

- Events Triggering Dissolution: Identify the specific events that can trigger dissolution.

(Example: Member vote, sale of assets, or judicial order.) - Winding Up Process: Outline the steps for settling liabilities and closing the LLC.

(Example: Notify creditors, pay off debts, file dissolution paperwork with the state.) - Asset Distribution: Define how remaining assets will be divided among members.

(Example: Distributed according to ownership percentages.)

FAQs - Common Questions about LLC Operating Agreements

1. What happens if I don’t have an LLC operating agreement?

If your LLC doesn’t have an operating agreement, state default laws will govern your business. These laws may not align with your business’s needs, leading to potential conflicts. For example, profits might be divided equally among members, even if their contributions are unequal, or important decisions could require unanimous approval, slowing operations.

Without an agreement:

- Role confusion can arise, leading to disputes over responsibilities.

- Members might not know when or how profits will be distributed.

- Personal liability risks increase, as courts may question the legitimacy of the LLC if it lacks formal documentation.

To maintain control and avoid conflicts, it’s essential to draft a custom operating agreement that defines how profits are shared, decisions are made, and roles are assigned.

Next Step: Avoid surprises—create your LLC operating agreement today with our custom templates.

2. Do I need an operating agreement for a single-member LLC?

Yes, even single-member LLCs need an operating agreement to protect personal assets and define the business’s structure. Without one, courts might "pierce the corporate veil," holding you personally liable for business debts. This could put your savings, home, or other personal assets at risk.

An operating agreement also:

- Establishes separation between personal and business finances to reinforce limited liability.

- Prepares for future changes, such as bringing in partners or selling the business.

- Satisfies lender requirements, as banks often request an agreement before approving loans.

3. How do I distribute profits in a multi-member LLC?

In a multi-member LLC, profits can be distributed based on ownership percentage or through special arrangements outlined in your operating agreement. Having clear rules helps prevent misunderstandings and ensures smooth operations.

Common Profit Distribution Methods:

- Ownership-Based: Each member receives profits proportional to their ownership share (e.g., 30% ownership = 30% of profits).

- Special Allocations: Members may agree to allocate more profits to those contributing extra capital, services, or expertise.

- Reinvestment Clause: Some profits can be retained in the LLC for business expansion or operating expenses.

Your agreement should also specify:

- Distribution frequency (e.g., quarterly or annually).

- Conditions for reinvestment versus payout.

- Loss allocation to handle financial downturns fairly.

4. What’s the difference between member-managed and manager-managed LLCs?

The key difference lies in who makes business decisions and handles day-to-day operations.

Member-Managed LLC

- Who Manages: All members actively participate in managing the business.

- Best For: Small businesses where owners want to stay involved in operations.

- Example: Members vote on decisions like hiring employees or purchasing equipment.

Manager-Managed LLC

- Who Manages: A designated manager (who may or may not be a member) handles operations.

- Best For: Larger businesses or LLCs where members prefer to act as passive investors.

- Example: Members appoint a manager to oversee daily tasks, allowing them to focus on high-level strategy.

Your operating agreement should specify the management structure to avoid confusion and disputes.

5. How do I dissolve my LLC legally?

To dissolve an LLC legally, you must follow specific steps outlined in your operating agreement and comply with state regulations. Proper dissolution ensures that all debts are settled and prevents future legal or financial liabilities.

Steps to Dissolve an LLC:

- Member Vote: Hold a vote among members to approve the dissolution, following the voting rules in your operating agreement.

- Notify Creditors: Inform creditors and vendors about the dissolution to settle any outstanding liabilities.

- File Dissolution Forms with the State: Submit the required documents (e.g., Certificate of Dissolution) to your Secretary of State.

- Settle Debts and Obligations: Use business funds to pay off any remaining debts.

- Return Member Contributions: Distribute the initial investments back to members, if applicable.

- Distribute Remaining Assets: Allocate any remaining assets based on ownership percentages or as specified in the agreement.

Following these steps helps avoid legal complications and ensures a smooth transition out of business.

6. Can I change my LLC operating agreement after it’s signed?

Yes, you can amend your LLC operating agreement to reflect changes in your business, provided you follow the procedures outlined in the agreement.

Common Reasons for Amending an Operating Agreement:

- Adding or removing members when ownership changes.

- Adjusting ownership percentages due to additional capital contributions.

- Updating profit-sharing rules to align with new business needs.

- Switching from member-managed to manager-managed structures.

How to Amend the Agreement:

- Review the Amendment Clause: Most agreements specify how amendments can be made, often requiring a unanimous or majority vote.

- Hold a Member Vote: Approve the changes as outlined in the agreement.

- Document the Amendment: Draft a formal amendment and have it signed by all members or the required majority.

- Update State Records (if needed): Some states require updated filings if significant changes occur, such as adding new members.

7. What’s the role of a registered agent, and should it be mentioned in my agreement?

A registered agent is responsible for receiving official documents on behalf of your LLC, such as legal notices, tax forms, and compliance reminders. Every state requires an LLC to have a registered agent with a physical address in the state where the business is registered.

Why Use a Registered Agent?

- Ensures Compliance: Handles important documents to keep your LLC in good standing.

- Privacy Protection: Keeps personal addresses off public records by listing the agent’s address instead.

- Reliable Notification: Ensures your LLC promptly receives critical notices, such as lawsuits or state filings.

Should the Agent Be Mentioned in Your Agreement?

While it's not mandatory, including the agent's details in your operating agreement provides clarity on who handles legal documents. This can be especially helpful if your LLC uses a professional registered agent service.

Legal Definition

An operating agreement is the governing contract adopted by members of a Limited Liability Company (LLC). It lays out the business's course and helps operations and management become more organized. It can be used to regulate nearly all aspects of the LLC's affairs, including how the business is managed, how assets are used, and how revenues are shared. It is similar to articles of incorporation, which control the operations of a corporation. (Cornell Law School)

Related Resources for LLC Operating Agreements

Explore these additional resources to understand LLC operating agreements and related topics. Whether you're forming a new LLC or refining your agreement, these guides will help you make informed decisions.

Top Articles and Guides

-

3 Reasons Why Your Single-Member LLC Needs an Operating Agreement

Discover why even single-member LLCs require an operating agreement to protect personal assets, clarify roles, and maintain legal compliance. -

The Ultimate Guide to Multi-Member LLC Operating Agreements

Learn how to structure agreements for multiple owners, manage roles, and ensure smooth profit distribution. -

Exploring the Purpose of Your LLC: What You Need to Know

Understand how to craft a purpose clause that aligns your LLC’s mission with its long-term goals. -

Understanding the Dissolution Clause in an LLC Operating Agreement

Get insights on how to wind up your business properly and distribute assets legally among members. -

Understanding the Profits and Loss Distribution Clause in LLC Agreements

Explore how to structure profit-sharing clauses to avoid disputes and ensure fairness among members. -

Comparing Member-Managed vs. Manager-Managed LLCs for Single-Member LLCs

Compare management structures and determine which model fits your LLC’s needs. -

LLC Duration: Understanding the Term of Your LLC

Learn how to set your LLC’s lifespan with clear duration clauses, whether for a specific period or indefinitely. -

LLC Contributions: How to Address Them in Your Operating Agreement

Learn how to record initial and future investments, prevent disputes, and maintain financial transparency. -

LLC Indemnity Clause: What to Know

Explore how indemnification clauses work and why they are essential for managing legal risks. -

The Role of a Registered Agent in Your LLC

Find out why registered agents are required and how they protect your business from missing important notices.

Related Resources for LLC Operating Agreements

Explore these additional resources to understand LLC operating agreements and related topics. Whether you're forming a new LLC or refining your agreement, these guides will help you make informed decisions.

Top Articles and Guides

-

3 Reasons Why Your Single-Member LLC Needs an Operating Agreement

Discover why even single-member LLCs require an operating agreement to protect personal assets, clarify roles, and maintain legal compliance. -

The Ultimate Guide to Multi-Member LLC Operating Agreements

Learn how to structure agreements for multiple owners, manage roles, and ensure smooth profit distribution. -

Exploring the Purpose of Your LLC: What You Need to Know

Understand how to craft a purpose clause that aligns your LLC’s mission with its long-term goals. -

Understanding the Dissolution Clause in an LLC Operating Agreement

Get insights on how to wind up your business properly and distribute assets legally among members. -

Understanding the Profits and Loss Distribution Clause in LLC Agreements

Explore how to structure profit-sharing clauses to avoid disputes and ensure fairness among members. -

Comparing Member-Managed vs. Manager-Managed LLCs for Single-Member LLCs

Compare management structures and determine which model fits your LLC’s needs. -

LLC Duration: Understanding the Term of Your LLC

Learn how to set your LLC’s lifespan with clear duration clauses, whether for a specific period or indefinitely. -

LLC Contributions: How to Address Them in Your Operating Agreement

Learn how to record initial and future investments, prevent disputes, and maintain financial transparency. -

LLC Indemnity Clause: What to Know

Explore how indemnification clauses work and why they are essential for managing legal risks. -

The Role of a Registered Agent in Your LLC

Find out why registered agents are required and how they protect your business from missing important notices.

-

What is an operating agreement?

An operating agreement is a legal document that outlines the ownership and operating procedures of a limited liability company (LLC). It covers essential aspects like management structure, profit and loss allocation, voting rights, and dispute resolution processes.

-

Do I need an operating agreement for my LLC?

While not always legally required in every state, having an operating agreement is highly recommended for all LLCs. It provides legal protection, establishes clear expectations among members, and can help prevent disputes in the future.

-

What should be included in an operating agreement?

Key components of an operating agreement typically include:

- Company information: Name, address, purpose of the LLC

- Ownership structure: Percentage of ownership for each member

- Management structure: How the LLC will be managed (member-managed or manager-managed)

- Voting rights: How decisions will be made and voting power allocated

- Profit and loss allocation: How profits and losses will be distributed among members

- Membership changes: Procedures for adding or removing members

- Dissolution: Procedures for dissolving the LLC

-

Can I create my own operating agreement?

Yes, you can create your own operating agreement, but it's highly recommended to consult with an attorney or use a professionally drafted template to ensure it's comprehensive, accurate, and complies with state laws.

-

How often should I update my operating agreement?

It's a good practice to review and update your operating agreement periodically, especially when there are significant changes in your business, such as new members, changes in ownership percentages, or changes in the management structure.

If you have more FAQs or want to tailor the answers to your specific audience or offerings, let me know!

Legal GPS Pro

Protect your business with our complete legal subscription service, designed by top startup attorneys.

- ✅ Complete Legal Toolkit

- ✅ 100+ Editable Contracts

- ✅ Affordable Legal Guidance

- ✅ Custom Legal Status Report

Table of Contents

Why Your LLC Needs an Operating Agreement

Find the Perfect Operating Agreement

How to Purchase and Use Our LLC Operating Agreement Templates

LLC Operating Agreement Sample Clauses and Key Provisions

Profit and Loss Distribution Clause

Capital Contributions Clause in an LLC Operating Agreement

%20(1).png?width=255&height=54&name=Untitled%20(1920%20x%201080%20px)%20(1).png)