LLC Family Trust Agreement

Planning to hold your LLC ownership through a family trust? Our LLC Family Trust Agreement Template helps document and formalize this structure, ensuring your ownership interest is protected, properly assigned, and aligned with your estate plan. This attorney-drafted agreement is perfect for estate planning, generational wealth transfer, or restructuring your LLC for long-term family control.

Last Updated: Apr. 8, 2025

Why Use Our LLC Family Trust Agreement Template?

Legally Transfer Your Interest to a Family Trust

-

Attorney-Drafted: Built by estate planning and business law professionals.

-

Trust Ownership Defined: Clearly documents the assignment of LLC interest to a family trust.

-

Estate Planning Aligned: Ensures your LLC ownership passes under the terms of your trust—not through probate.

Designed for Long-Term Family Planning

-

Supports Generational Control: Ideal for passing down ownership across generations.

-

Avoids Probate and Disputes: Keeps your LLC interest within the trust structure and outside the courts.

-

Integrates with Wills, Trusts, and Operating Agreements: Works within your full estate and business plan.

Easy to Edit and Implement

-

Editable in Microsoft Word: Quickly fill in trust names, trustees, LLC details, and assignment terms.

-

Optional Consent Language: Includes provisions if your operating agreement requires member approval.

-

Formatted for Signatures: Signature and execution section ready to go.

| Premium Template Single-use Template |

Legal GPS Pro Unlimited Access, Best Value |

|

|

|

$35

|

$39/ month

|

| Buy Template | Explore Legal GPS Pro |

| Trusted by 1000+ businesses | |

How to Purchase and Use the Family Trust Agreement

🛒 Step 1: Complete Your Purchase ($35 per Template)

Add the LLC Family Trust Agreement template to your cart and check out securely. You’ll receive the document instantly via email.

📥 Step 2: Customize in Word

Open the file and enter your LLC information, trust name, trustee details, and the membership interest being transferred.

👥 Step 3: Review with Your Legal Advisor and Co-Members

Ensure the transfer is compliant with your operating agreement and consistent with your overall estate plan.

✍️ Step 4: Sign and Store with Your Legal Records

Once signed, store the document with your trust and LLC paperwork. Consider providing a copy to your registered agent or business attorney.

🎯 Ready to Align Your LLC with Your Family Trust?

Download the LLC Family Trust Agreement and take the next step in securing your business legacy.

Key Features of the LLC Family Trust Agreement Template

-

Trust Assignment Language: Transfers LLC ownership interest into your family trust.

-

Trustee Acknowledgment Section: Documents that the trustee accepts and agrees to hold the interest.

-

Consent Clause (Optional): Includes optional approval language for other members.

-

Execution & Signature Block: Fully formatted for signatures and optional notarization.

-

Flexible for Any Trust Type: Works for revocable, irrevocable, and dynasty trusts.

Benefits of Our Family Trust Agreement Template

Family and Estate Planning Benefits

-

Avoid Probate: Trust-owned assets transfer according to your plan, not the court’s.

-

Keep the Business in the Family: Centralizes ownership in a long-term trust structure.

-

Minimize Disputes: Clarifies control and succession of the LLC.

Simple and Cost-Effective

-

No Attorney Drafting Needed: Save time and legal fees with a professional, editable document.

-

Immediate Download: Use the template right away.

-

Reusable Format: Apply the same structure across multiple LLCs or family trusts.

| Premium Template Single-use Template |

Legal GPS Pro Unlimited Access, Best Value |

|

|

|

$35

|

$39/ month

|

| Buy Template | Explore Legal GPS Pro |

| Trusted by 1000+ businesses | |

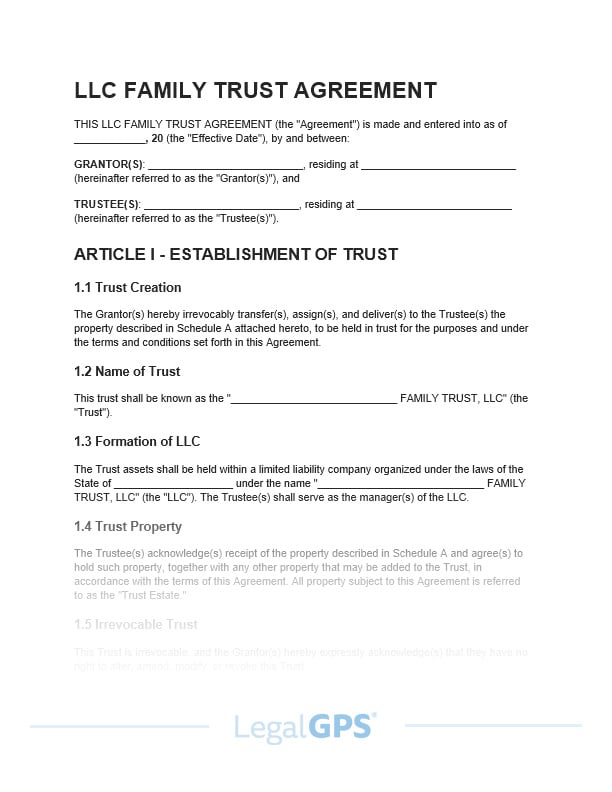

Quick Look: LLC Family Trust Agreement

| Feature | What It Means for You |

|---|---|

| Attorney-Drafted Template | Built for trust-based ownership of LLC interests |

| Trust Assignment Language | Transfers interest into the named family trust |

| Trustee Acknowledgment | Ensures the trustee agrees to manage the interest |

| Consent Clause (Optional) | Covers approval if required by the operating agreement |

| Execution & Signature Section | Formatted for signatures and optional notarization |

| Editable Word Format | Easily customizable with your details |

Frequently Asked Questions

Q: What is the purpose of this agreement?

A: It formally transfers your LLC ownership interest into a family trust, allowing the trust to hold, control, and distribute the interest according to your estate plan.

Q: Can this be used with revocable or irrevocable trusts?

A: Yes. The language is designed to be flexible enough to support various trust types.

Q: Do I need other members’ consent?

A: Possibly. If your operating agreement restricts ownership transfers, this template includes optional consent clauses to meet those requirements.

Q: Does this get filed with the state?

A: No. You keep it in your private business and trust records, unless your LLC has specific filing rules.

Q: Should I have my attorney review it?

A: While it’s designed for self-use, we recommend reviewing with your estate or business attorney to ensure full compliance and peace of mind.

Why This Agreement Matters

-

Solidifies Trust Ownership: Clearly shows that your LLC interest is held by the family trust.

-

Aligns with Estate Goals: Ensures business assets follow the distribution plan you’ve created.

-

Reduces Legal Risks: Provides documentation to prevent confusion or challenges later.

-

Supports Long-Term Continuity: Helps maintain family control of the LLC across generations.

| Premium Template Single-use Template |

Legal GPS Pro Unlimited Access, Best Value |

|

|

|

$35

|

$39/ month

|

| Buy Template | Explore Legal GPS Pro |

| Trusted by 1000+ businesses | |